By Priyansh Bharadwaj , 2nd year B..A. LLB. (Hons.) student at DNLU, Jabalpur

Introduction

The recent news that Plutus, a Cardano-based smart contracts platform, has increased more than 100 Smart contracts on its platform over the period of two days, has underlined the fact of the growing popularity of the smart contract in the commercial world. Moreover the Indian Government plans to introduce law to regulate Cryptocurrency and the recent imposition of the tax on the income of digital asset in the Budget 2022, have showcased that the Central Government is in no mood to impose complete ban on the use of cryptocurrency as a means of exchange. These two incidents have shown the need to formulate a law to regulate trading done via Smart Contract in order to protect the rights of the consumers in India.

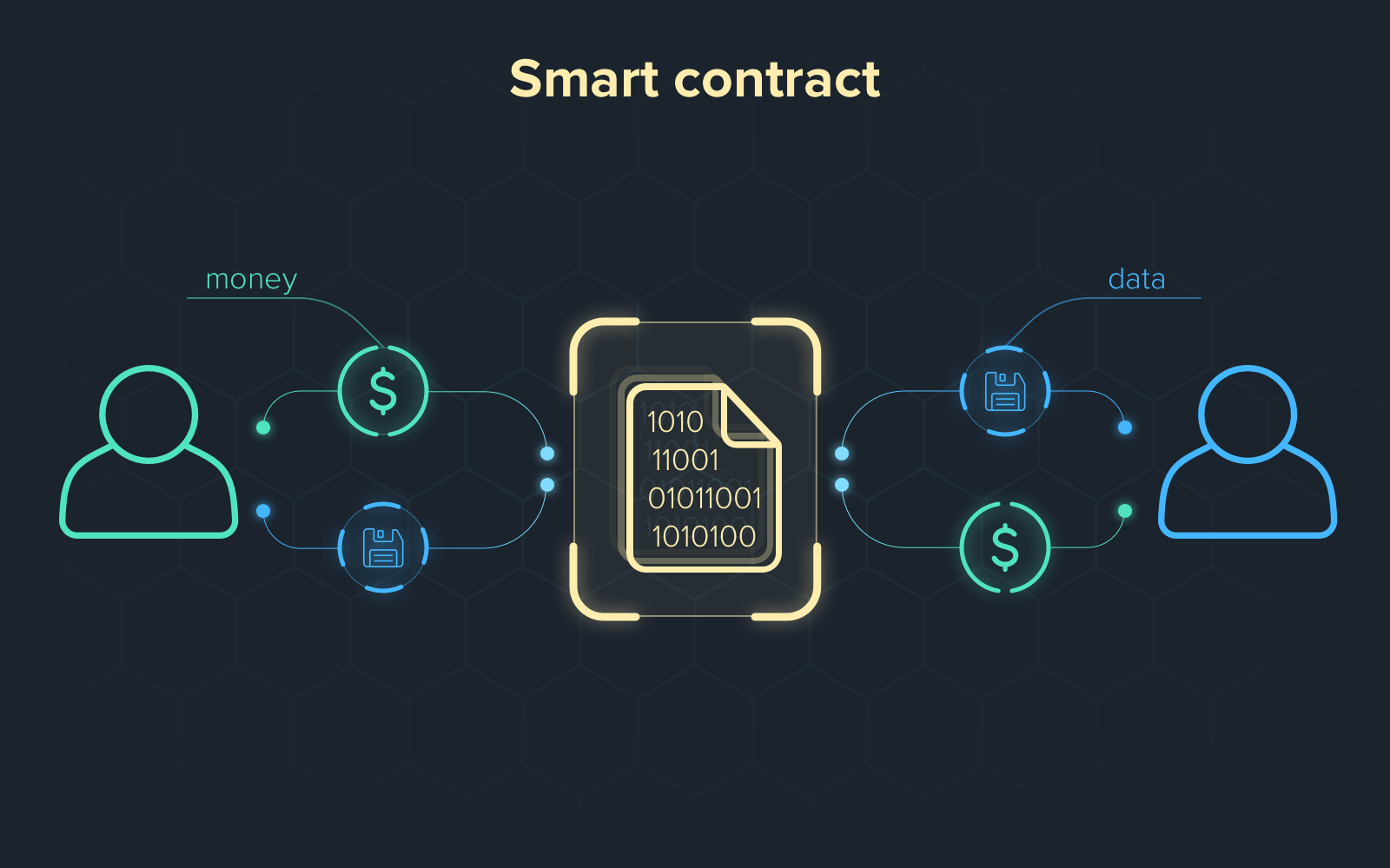

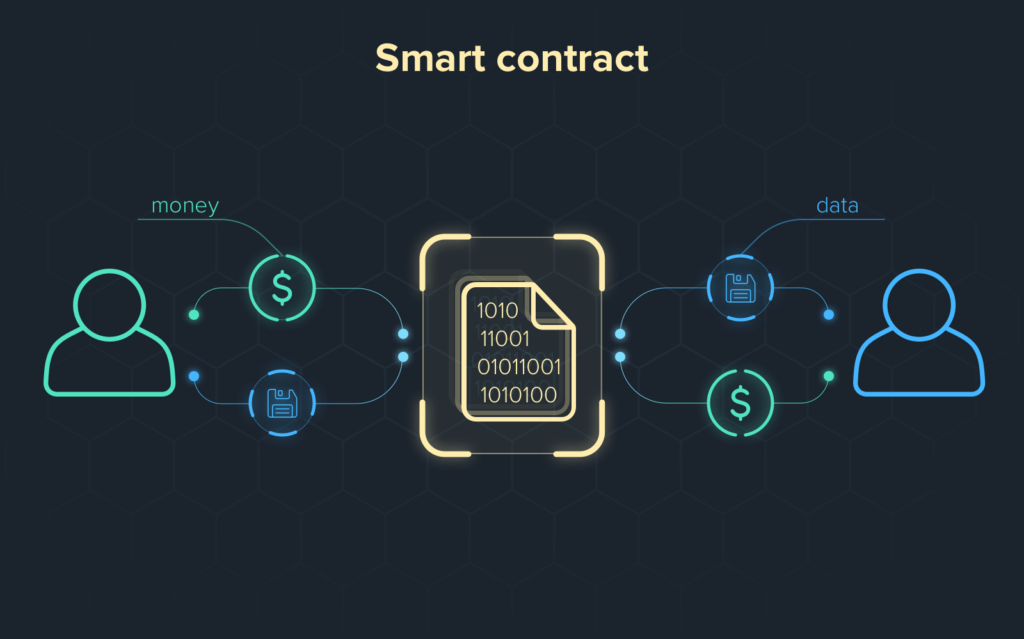

Smart Contract is a set of instructions that are executed by the algorithms without any need for human intervention. It works on blockchain technology, which means that it is decentralized and there is Distributed Ledger Technology that makes all the transactions visible to all the members who are the part of the chain thereby, reducing the chance of duplicate use of the virtual asset. Smart Contract works on the If-Then principle and on the fulfillment of a particular condition, the contract is executed in the instructions specified in the contract. Thus, there is no need for the human to seek enforcement of the contract and there is speedy-execution of the contract.

Need for Consumer friendly Legislation for Smart Contract

The cardinal principle of consumer protection legislation is to safeguard the rights and interests of the consumer and provide effective remedy to the consumers against the unfair trade practices done by the powerful corporations. The rapid use of smart contracts in business transactions demands a law to overcome the following drawbacks of the technology.

- Automatic Execution sans hearing

The first and foremost challenge that Smart Contract poses is that there is execution of the conditions of the contract automatically without any human intervention. Since Artificial Intelligence does not have the ability to think according to a particular case, rather it works on the set of instructions programmed; it is highly plausible that the AI may be wrong in applying the conditions as it cannot take into account the emotional or other circumstances that can affect human conduct, thus severely affecting consumer satisfaction. There is no mechanism through which a consumer can seek explanation as to how a contract is executed and it is antithesis to the right of explanation as enshrined under the Proposed Personal Data Bill, 2019.

- Unalterable according to the need of situation

The second challenge, which Smart Contract highlights, is the code once programmed in the contract cannot be altered at any cost. This highlights that the parties to the contract do not have the liberty to alter the contract accordingly to the need of the time after the contract comes into existence. Since, the smart contract cannot be changed and its enforceability cannot be stopped, the parties to the contract have no option to seek for the termination of the contract before the completion of the contract. This creates a problem where the consumers suffer due to non-availability of the power to terminate the contract. For example, A signs a smart contract with B, in which B agrees to sing on A’s birthday. Here A is the consumer and B is providing service to A for some consideration. Due to some unexpected circumstance, A died before his birthday, this makes contract under present Indian Contract Law, void, and cannot be enforced by B in the court of law. However, in the case of Smart Contract, the contract is valid and since there is non-fulfillment of obligation by A, B will be automatically compensated according the instructions prescribed in the smart contract.

- Useful in enforcing Void and Illegal Contract

The next problem that applicability of Smart Contract highlights is that enforceability of the void and illegal contract will become easier and this will in turn gives rise to increase in the criminal and illegal activities. Under section 30 of the Indian Contract Act, 1872, the wager contract is void and is unenforceable in the court. In the case of Vikram Seth v. Public Prosecutor, the Madras High Court has clarified in games, where the outcome depends upon the preponderance of chance; the game is wager, thus unenforceable. However, using the Smart Contract, the wager contract can be enforced by the parties without any legal recourse. This can be achieved by prescribing instructions that on the happening of a particular outcome, the pre-decided amount of cryptocurrency shall be transferred to the winning party’s account from the losing party’s account. This will give encouragement to the illegal activities like gambling. Thus, the prevalence of smart contract without any regulation can blur the line between the valid or invalid contract, thereby severely harming the interest of the consumers as the company can impose unreasonable condition in the code and seeks its enforceability without any hindrance.

- Encourages cartelization and unfair trade practices

Another problem that prevalence of smart contract highlights is the increase in collusion and cartelization among big companies. As per the section 3 of the Competition Act of India, 2002, all types of agreements that hinder fair competition are prohibited. The big companies can enter into anti-competitive agreement and execute it with smart contract by prescribing the penalty for the company that deviates from the agreement. Since, the deviating party can be punished easily; this will make the anti-competitive agreement more effective. Moreover, the smart contract works on the principle of pseudonymity, according to which, the user of the smart contract will be given fictitious name and their real world identity will remain hidden. This causes a problem for the law enforcement authorities to find out the true identity of the user and thereby, the chance of imposing penalty on such enterprises is difficult. Since, the competitors can enter into anti-competitive agreement without any fear of detection, it will stifle the fair competition in the economy and innovation, as result of it, the consumers can be exploited by the group of competitors.

- Machine Language Contract and non-applicability of purposive interpretation

The language in which the smart contract is written or coded itself presents a major challenge to the legal scholars and judges. The smart contract is coded or drafted in the language of machine such as Phyton, Java. Advocates and Judges are not trained to read the language of smart contract. This presents a challenge whenever, a question arises regarding the enforceability of the contract. Since, the judges are not versed in the language of the smart contract, they will not be able to interpret the contract and it will prove harmful to the interests of the consumers. It is also against the established principle of interpretation of standard contract as propounded in the case of Central Inland Waterways v. Brojo Nath Ganguly. In this case, it was held in case of standard contract, the court shall interpret the contract in accordance with the interests of the weaker party. Furthermore, Machine language cannot be interpreted in a particular situation rather it works on the principle of the fulfillment of the condition.

Proposed Solution

The law must mandate that any person aggrieved by the automatic execution of smart contract shall have the right to appeal in a speedy manner and burden of proof must be on the mightier party to prove that there is no fraud committed by it. In order to counter the problem of enforceability of void and illegal contract, the law shall make it mandatory for the drafters of the smart contract to obtain license to draft the contract from the authority concerned. Any smart contract made by drafter without obtaining license must be treated as a void contract and such drafter should be punished with imprisonment. The authority must have the power to revoke the license of the drafter who writes a smart contract enforcing an illegal agreement and should be punished with a criminal sentence if he intentionally drafted an illegal or void contract. In order to prevent enforcement of anti-competitive contract, an anti-competitive agreement must be recognized as an illegal contract. It must be obligatory that there shall be a translation of code of the smart contract into a readable contract at the execution of the contract and the same must be provided to weaker party at the time of execution of contract and to the court in case of dispute regarding the contract.

Conclusion

Smart Contract offers a huge potential for the consumers as the performance of the contract can be enforced easily and this will also help to reduce the burden of the court. There is a need for the Indian Parliament to frame a law regulating the smart contract with special focus on protecting the consumers against the malpractices that can be conducted with the aid of smart contract. The government must also introduce some kind of training for the law enforcement agencies to understand the smart contract technology in order to prevent the misuse of the smart contract.